debt – could it be good?

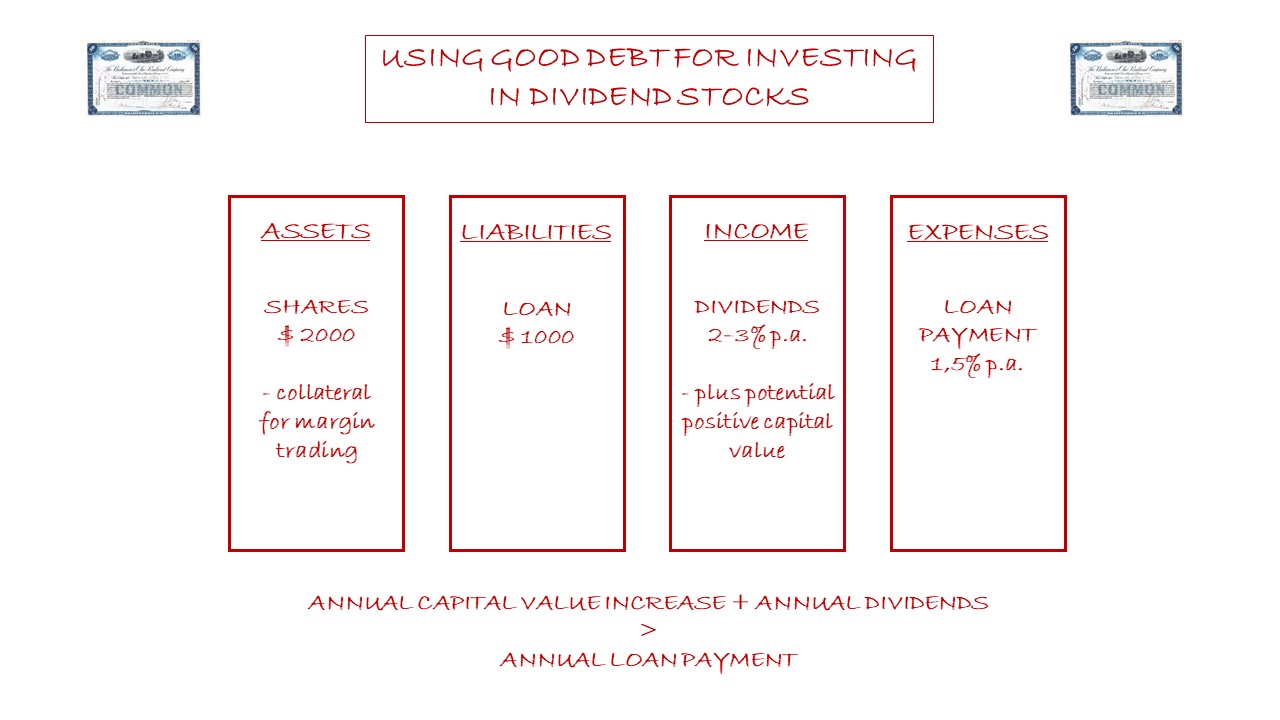

There is also a way leveraging the debt to invest in dividend stocks. Let’s say that you owns the shares worth $2000. You have an annual dividend income from these shares which is 2-3%. Such dividend income can be achieved by buying shares of quality companies. Investment to the quality companies is usually low-risk – from the stocks market perspective – because such companies have a very long dividend history with yearly dividend growth, high market capitalization and they also usually provide stable capital value increase over the time.

In order to buy more dividend stocks when you currently have no free money, you can enable margin trading on your broker account.

With margin trading, your $2000 in shares will serve as a collateral so that you can buy some new shares using a loan from the broker. It is good to review the currency interest rates list on the broker site to find out one of the world’s most used currencies together with the low interest rate. At this moment (August 2019), there is a very low interest rate for the EURO currency. It is 1.50% p.a. so you would probably use EURO for the loan. The interest rates vary from broker to broker.

If you want to buy some stocks quoted in the US dollar, you sell the EURUSD currency pair to make a loan in EURO for 1.50% p.a. (August 2019) and get the respective amount of US dollars. For example, to get $1000, you have to sell EURUSD currency pair for EUR 854.70 if the exchange rate is 1.17. Those EUR 854.70 is your loan from the broker and you will pay 1/12 (one twelfth) of 1.50% interest rate to the broker every month. The good thing is that you pay just the interest, not the principal, so theoretically you can leave this loan active forever and just pay the interest.

Now you have your own shares worth $2000, providing dividend income 2-3%, with increasing capital value constantly in the long term horizon, and the loan from the broker worth $1000 (actually 854.70 EUR) with interest rate of 1.50% p.a.

Because the dividend yield and the capital value of your stocks exceeds the interest rate of the loan, you can pay for the interest of the loan partially from the dividend income of the shares bought for the borrowed money and also you can pay for part of the loan principal by the rest of the dividend income.

Congratulations, you are now using good debt for investing in dividend stocks!!!

Share this Page